Swiss international climate finance

Switzerland is committed to contributing its fair share to the global effort of supporting climate action in developing countries. This section provides an overview of Switzerland’s public and mobilized private climate finance, drawing on data reported by all relevant federal entities.

Up-to-date statistics and background information are presented here to inform stakeholders and the public about the volume and composition of Swiss international climate finance. This includes both direct public contributions and mobilized private finance—private capital that is mobilized by public interventions for climate-related activities.

Switzerland’s international climate finance consists of three main components:

- Bilateral climate finance includes projects and programs directly implemented by Swiss institutions, primarily SDC and SECO, in partner countries. These are identified using the OECD Rio Markers for climate change mitigation and adaptation. The financial volume is calculated by applying fixed percentages to each project depending on whether climate is a principal (85%) or significant (50%).

- Multilateral climate finance refers to core contributions to multilateral development banks and climate-related funds. Since these are not earmarked for specific climate activities, Switzerland uses imputed shares—climate-specific coefficients published by the OECD—to estimate the climate-relevant portion of its contributions.

- Mobilized private climate finance captures the volume of private capital leveraged through public interventions, such as guarantees, equity investments, or concessional loans. These amounts are reported in line with the OECD methodologies for tracking mobilization and reflect Switzerland’s capacity to catalyze climate investment from the private sector.

Overview of Trends

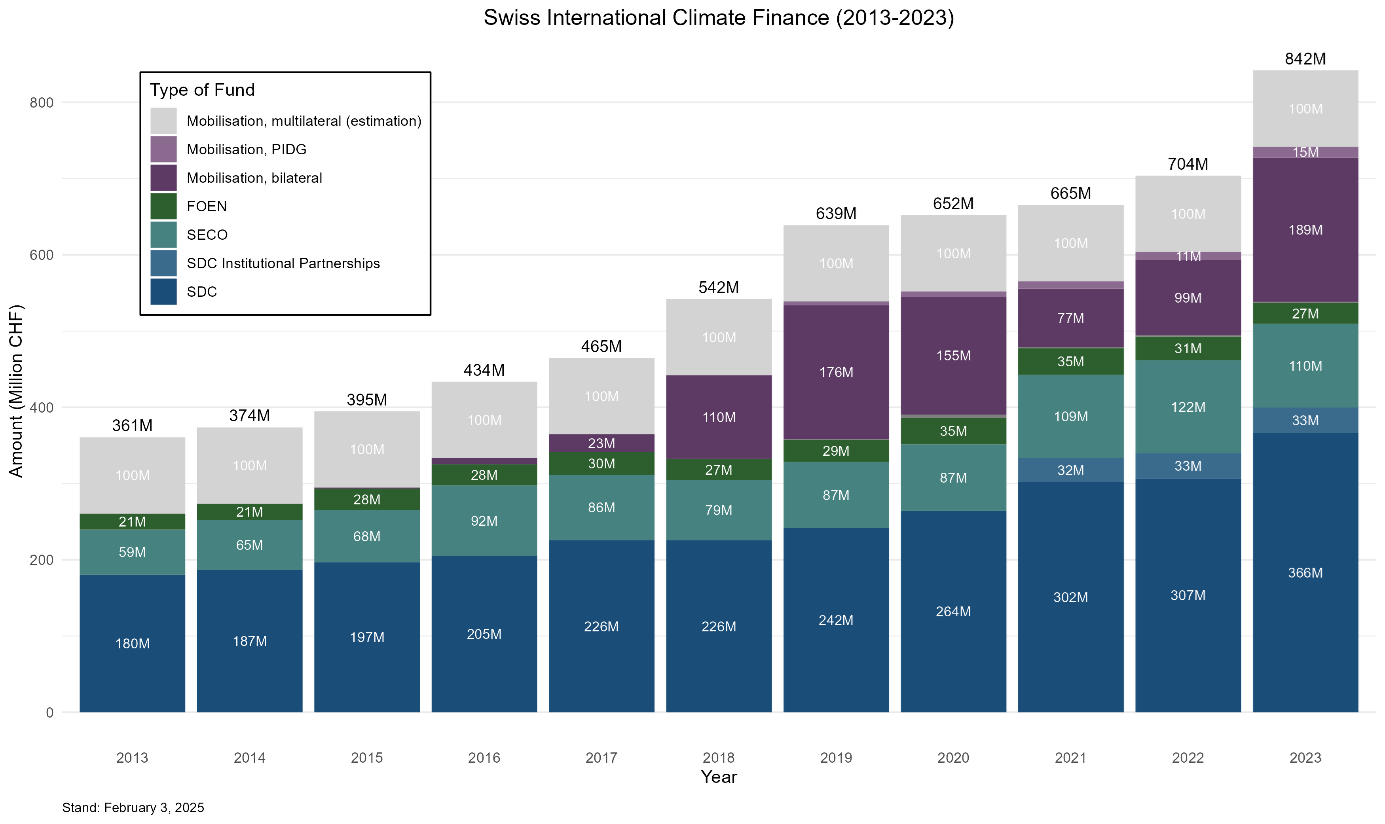

- Total public climate finance climbed from CHF 360.6 million in 2013 to CHF 842 million in 2023.

- Switzerland's fair share of the 100 billion USD climate finance goal was estimated at 400–650 million CHF. The upper bound of this range was already reached in 2020.

- The share of private finance being mobilized by official interventions (mobilisation) has significantly increased, especially in 2023, demonstrating Switzerland's capacity to attract private sector participation. However, these funds can vary significantly from year to year, as large amounts are often mobilized by single interventions.

- SECO contributions remain mostly stable, while SDC funding shows consistent growth.

- In 2023, climate finance accounted for approximately 11% of Switzerland's total official development assistance (ODA).

Accounting for Switzerland's International Climate Finance (methodological note)

Switzerland reports its international climate finance in line with OECD-DAC guidelines and methodologies, ensuring consistency, transparency, and comparability with other donor countries.

Reporting of the climate finance data is done on a yearly basis to the OECD-DAC and other international platforms (e.g., UNFCCC Biennial Reports). In the following, the methodology used to account for contributions to climate finance through different channels is outlined in brief.

Bilateral Climate Finance

Switzerland supports international climate action through direct bilateral cooperation projects, managed mainly by institutions the Swiss Agency for Development and Cooperation SDC and the State Secretariat for Economic Affairs SECO.

To assess whether a project contributes to climate change mitigation or adaptation, the OECD-DAC Policy Markers (PM) for Climate Change Mitigation and Adaptation are applied as follows:

- For a principal objective, i.e. if climate action is the main goal, 85% of the activity’s budget is counted.

- For a significant objective, i.e. if climate action is an important secondary goal, 50% of the activity’s budget is counted.

- If climate action is not a relevant objective, the intervention is not targeted and accordingly, 0% of the activity’s budget is counted.

Projects can be marked for both mitigation and adaptation. In such cases, fixed allocation rules are applied to prevent double counting as follows:

Project allocation assessments are carried out by programme managers and reviewed through a centralized quality control mechanism.

Multilateral Climate Finance

Switzerland contributes core funding to Multilateral Development Banks MDBs, UN agencies, and climate funds. These institutions finance a variety of activities, including climate-related interventions.

Since core contributions are not earmarked for specific purposes, Switzerland uses imputed shares—also known as climate coefficients—to estimate the climate-relevant portion of its contributions. These coefficients, published by the OECD (Link), reflect the share of each institution’s overall disbursements that support climate change mitigation or adaptation.

For example, if a MDB has a climate coefficient of 30%, then 30% of Switzerland’s core contribution to that respective MDB is counted as climate finance.

In very rare and well-justified cases, Switzerland may apply tailored coefficients to individual institutions to ensure continuity and consistency with past reporting.

Mobilized Private Sector Finance

Switzerland also helps to attract private sector investment in climate-related projects. This is known as mobilized private finance.

Switzerland reports these amounts when public interventions—such as guarantees, loans, or equity investments—help trigger private investments for climate purposes.

The climate share of mobilized finance is generally determined using the Policy Marker system, just like for bilateral projects. This allows Switzerland to estimate what portion of private finance is supporting climate mitigation or adaptation.

While several activities fall under this category, the main channels for mobilized private sector finance currently include:

- SIFEM (Swiss Investment Fund for Emerging Markets)

- PIDG (Private Infrastructure Development Group)

- SERV (Swiss Export Risk Insurance)

Mobilized amounts vary significantly from year to year depending on the nature and size of the transactions.

For more detailed information on Switzerland’s climate finance reporting, please contact: stats.sdc@eda.admin.ch